Dayton's Premier HVAC & Plumbing Specialists

Dayton's premier HVAC company and plumbing specialists, Wind Bender Heating Cooling Plumbing LLC, are dedicated to delivering exceptional service and expertise to meet all your heating, cooling, and plumbing needs. With a focus on quality craftsmanship and customer satisfaction, our team of specialists is equipped to handle installations, repairs, and maintenance with precision and efficiency.

We pride ourselves on providing reliable solutions tailored to your specific requirements, ensuring your home or business remains comfortable and functional year-round. When you choose Wind Bender Heating Cooling Plumbing LLC, you're choosing a trusted partner for all your HVAC company and plumbing needs in Dayton.

Learn More About Us

Heating Installation & Repairs In Dayton

When it comes to heating installation and repairs in Dayton, Wind Bender Heating Cooling Plumbing LLC stands as the go-to expert. Our dedicated team of technicians possesses extensive knowledge and experience in handling all aspects of heating systems, from efficient installations to thorough repairs.

We understand the importance of a reliable and well-functioning heating system, especially during the colder months, which is why we prioritize prompt and effective solutions for our customers. Whether you need a new heating system installed or require repairs for your existing one, you can trust Wind Bender Heating Cooling Plumbing LLC to deliver exceptional HVAC company service and ensure your home or business stays warm and comfortable.

View Our Heating ServicesGeothermal Heat Pumps

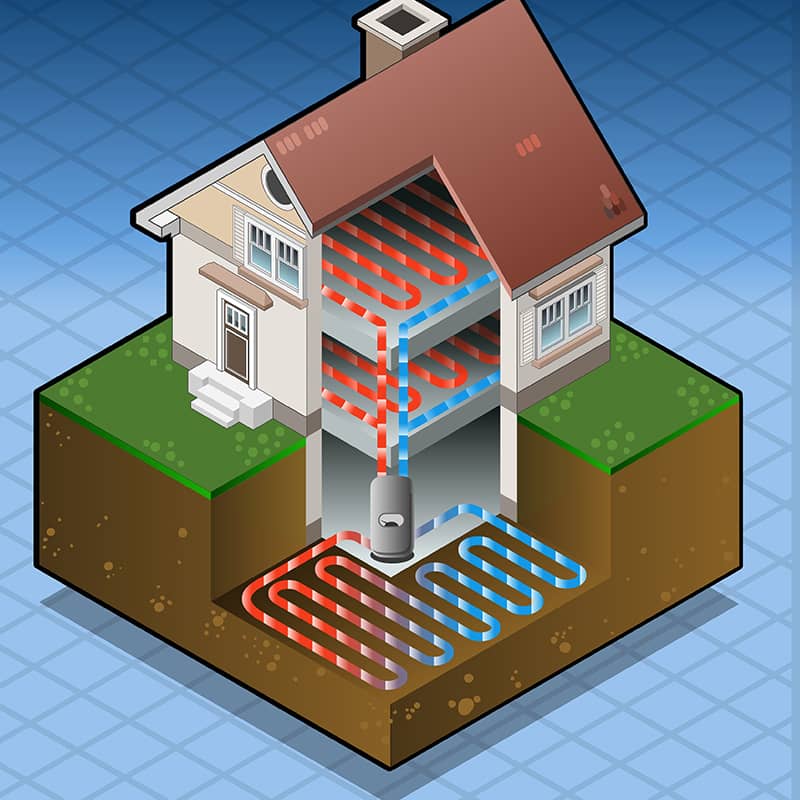

Geothermal heat pumps represent a cutting-edge and eco-friendly solution for heating and cooling needs, and Wind Bender Heating Cooling Plumbing LLC is proud to be at the forefront of this technology in Dayton. Geothermal systems harness the natural heat from the earth to provide efficient heating in winter and cooling in summer, offering significant energy savings and environmental benefits. Our team of experts specializes in the design, installation, and maintenance of geothermal heat pump systems, ensuring optimal performance and longevity.

At Wind Bender Heating Cooling Plumbing LLC, we understand the unique advantages that geothermal heat pumps offer, such as consistent and reliable comfort, reduced carbon footprint, and long-term cost savings. We work closely with our clients to assess their property's suitability for a geothermal system and tailor solutions that meet their specific needs and budget. Whether you're looking to upgrade to a greener heating and cooling solution or need expert maintenance for your existing geothermal system, Wind Bender Heating Cooling Plumbing LLC is your trusted partner for all things geothermal in Dayton.

Find Out More About Geothermal Heat Pumps

A PLUMBING COMPANY YOU CAN RELY ON!

Locally Owned & Operated

Wind Bender Heating Cooling Plumbing LLC is proud to be a locally owned and operated plumbing and HVAC company, serving the Dayton community with personalized and dedicated service.

Trained & Certified

Our technicians are extensively trained and certified, ensuring that they have the expertise and knowledge to handle all HVAC and plumbing needs with professionalism and precision.

Professional & Reliable

Choose Wind Bender Heating Cooling Plumbing LLC for your HVAC and plumbing needs because we are known for our professionalism and reliability, ensuring that your project is handled with the utmost care and expertise.

WHAT OUR CUSTOMERS ARE SAYING

"After our old gas furnace broke down, we purchased a dual-fuel wood/gas furnace. Wind Bender Heating Cooling Plumbing LLC stepped in and took on the job. They had the old furnace out a [...]"

G & W Beaverson, Woodstock, Ohio

"We just wanted to let you know how pleased we are with the geothermal installation that Wind Bender Heating Cooling Plumbing LLC recently completed. Because our 1870's house needed 3 s [...]"

R. Teclaw, Richmond, IN

"We can't Thank You enough !!! Linda has a heart condition that the heat and humidity only makes worse. Our heat pump went out (which means no air conditioning) we called a few plac [...]"

M. Montgomery, Dayton, OH

"We can't Thank You enough !!! Linda has a heart condition that the heat and humidity only makes worse. Our heat pump went out (which means no air conditioning) we called a few places for prices and availability to put in ASAP. Wind Bender Mechanical Services, LLC not only beat the prices, but totally wiped out the completion!!!"

Ron & Linda Kemp, Xenia, OH

MAKE SURE YOU'RE COMFORTABLE ALL YEAR ROUND

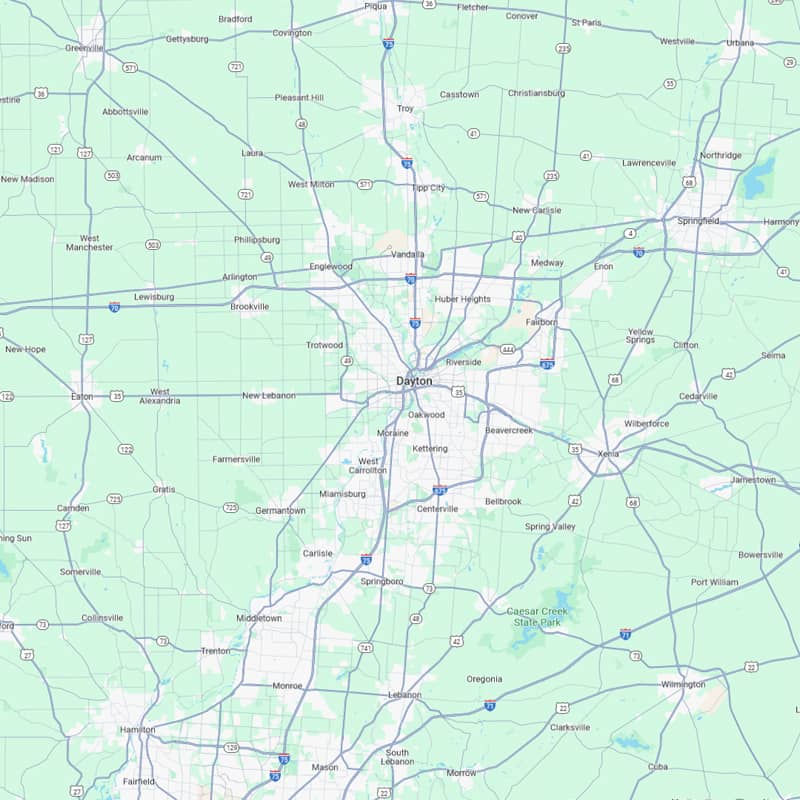

Areas We Service

Let us take care of your HVAC and plumbing needs in our service areas, where our team at Wind Bender Heating Cooling Plumbing LLC is dedicated to providing top-notch services tailored to your specific requirements. With our expertise and commitment to excellence, you can trust us to handle everything from installations to repairs with professionalism and reliability. Experience peace of mind knowing that your home or business is in capable hands with Wind Bender Heating Cooling Plumbing LLC.

RECENT ARTICLES

-

The Best Reasons to Opt for Water Softeners for Your Dayton Home

Are you tired of dealing with hard water issues in your Dayton home? Water softeners can be the solution you've been looking for. Hard water, which contains high levels of minerals like calcium and magnesium, can cause a range of problems from scale buildup in pipes […]

-

The Importance of Indoor Air Quality Services

In our modern lifestyles, we often focus on the quality of the air we breathe outdoors, but what about the air inside our homes and workplaces? Indoor air quality (IAQ) plays a significant role in our health, comfort, and overall well-being. Indoor air quality services are […]

FREQUENTLY ASKED QUESTIONS

At Wind Bender Heating Cooling Plumbing LLC, we specialize in a wide range of heating installations to suit your needs. Whether you're looking for a traditional furnace, a modern heat pump, or even a geothermal system, we have the expertise to handle it all. Our team is trained and certified to perform efficient and reliable installations that ensure your home or business stays comfortably warm during the coldest months. We also offer consultations to help you choose the right heating system based on your property size, budget, and energy efficiency goals. Trust us to deliver top-notch heating solutions tailored to your requirements.

Indoor air quality (IAQ) is crucial for several reasons. Firstly, poor IAQ can lead to health issues such as allergies, respiratory problems, and asthma exacerbations, particularly for vulnerable individuals like children and the elderly. Secondly, good IAQ enhances overall comfort by reducing odors, humidity levels, and pollutants that can cause discomfort and irritation. Additionally, improved IAQ promotes productivity and well-being in indoor environments, making it essential for homes, offices, and commercial spaces. At Wind Bender Heating Cooling Plumbing LLC, we offer IAQ solutions such as air purifiers, ventilation systems, and humidity control to ensure that you breathe clean and healthy air indoors.

Detecting a leak in your plumbing system is crucial to prevent water damage and high utility bills. Signs of a leak include unusually high water bills, damp or discolored spots on walls or ceilings, mold growth, musty odors, and the sound of running water when no fixtures are in use. You may also notice a decrease in water pressure or visible water pooling around fixtures. If you suspect a leak, it's important to contact Wind Bender Heating Cooling Plumbing LLC promptly. Our skilled technicians can conduct a thorough inspection using specialized equipment to locate and repair any leaks efficiently, restoring your plumbing system's integrity.

While it may seem tempting to tackle drain cleaning yourself, it's often best left to professionals like Wind Bender Heating Cooling Plumbing LLC for several reasons. DIY methods like chemical drain cleaners can be harmful to your pipes and the environment, causing corrosion and damage over time. Additionally, without proper tools and expertise, DIY efforts may only provide temporary relief and fail to address the underlying cause of the clog. Our experienced technicians use safe and effective methods such as hydro-jetting and snaking to clear drains thoroughly and prevent future blockages, ensuring your plumbing system remains in optimal condition for the long term.

DON'T WAIT! CONTACT WIND BENDER HEATING COOLING PLUMBING LLC FOR ALL YOUR HEATING, COOLING, AND PLUMBING NEEDS IN DAYTON